Stitch Fix, with a C-suite in transition and struggling against a string of declines, is shifting its model again. This time, the apparel box retailer is undoing initiatives designed to spark growth that instead have undermined its performance.

“I realize we haven't met recent expectations,” Founder Katrina Lake, who returned as CEO on an interim basis in January, told analysts Tuesday. “Driving towards an ambitious vision has resulted in a loss of focus.”

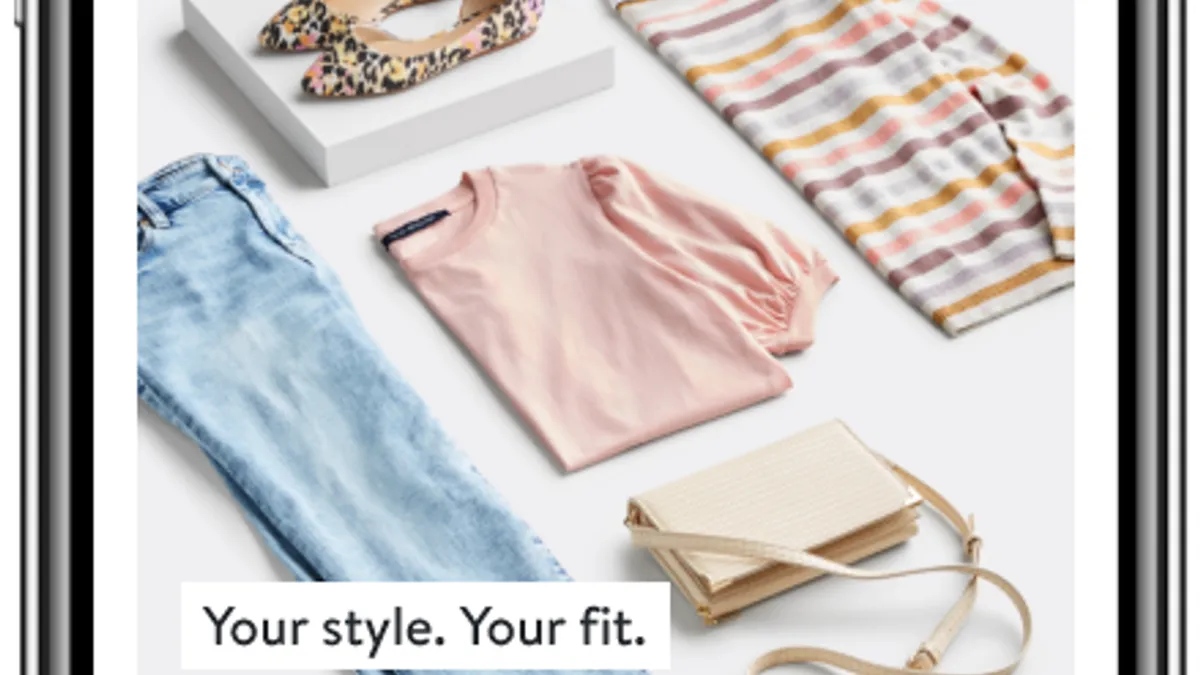

Lake vowed to regain focus, and described a return to the company’s original differentiation — pairing algorithms and human stylists to send outfits to customers, who subscribe to the service on an ad hoc basis or a frequency of their choosing.

The business model has likely grown too complicated, with some aspects interfering with their core idea, according to Tarek Abdallah, a professor of operations at Northwestern University’s Kellogg business school. That makes it difficult to identify problems, said Abdallah, whose areas of research include revenue, pricing and other management issues in traditional and innovative marketplaces, including subscription services. “Hence, it is a good sign that they are cutting down on the recent ambitious initiatives to focus more on their core product/service which is the subscription model," he said by email.

“If Stitch Fix were a cat, it’s reached its ninth life."

Rick Watson

Founder & CEO, RMW Commerce Consulting

The question remains how the company will profitably grow, with a model that has been ditched by Nordstrom and ThredUp, among others, and without the tweaks meant to help achieve scale.

“If Stitch Fix were a cat, it's reached its ninth life. This was supposed to be the next evolution of that model, where you're not required to be in a long subscription, you just pay for your Fixes as you need them,” Rick Watson, founder and CEO of RMW Commerce Consulting, said by phone. “That almost has the worst parts of two different business models — you have fashion online, which is hard on its own because of crushing returns costs. You have trendy inventory, no consistent customer base and no predictable revenue stream to make up for those things, because you don't have a long term subscription with the customer.”

What’s going back

Stitch Fix’s biggest about-face is at Freestyle, the direct-buy option that got a new name in 2021 when it was opened up to shoppers beyond the company’s styling box subscribers. An a la carte choice can boost a subcription company’s business, as long as it has sufficient inventory and appropriate pricing, according to Abdallah.

But signs of trouble emerged right away. The company belatedly added a search function, which had been left off in favor of surfacing AI-driven personalized suggestions. About a year after the expansion, the company once again limited Freestyle to people who are subscribers of its curated boxes, known as “Fixes.”

“Not only did we find that marketing of Freestyle ... wasn't as effective as what we have done historically in Fixes, but it also actually made it harder for us to be able to be acquiring people into the Fix channel,” Lake said.

Freestyle will now be used to unload excess inventory, rather than offload it to third-party liquidators, and allow Fix customers to make supplemental purchases. But it is no longer positioned as a customer acquisition tool, and the company is scaling down what had been robust marketing spend to fuel it, executives said.

Further, while the company had been working to build up its assortment of name brands for Freestyle, including Free People, Universal Standard, Vince, Madewell, Mother, Rag & Bone, The North Face, Club Monaco and Girlfriend Collective, among others, they haven’t met expectations, according to Lake.

“Candidly, those brands haven't performed as well in the Freestyle experience, although better than in the Fix experience,” she said. “Longer term, the national brands will probably be a smaller part of our portfolio going forward, in the way that they were historically with Fixes. And I would actually really position that as a positive, as being a testament to our personalization. At the end of the day, even if it's not a brand that somebody recognizes, if you're delivering jeans that fit someone, someone's going to buy them.”

In renewing its emphasis on its private label portfolio, Stitch Fix joins several other retailers, including Kohl’s and Macy’s. Having more exclusive brands and fewer national brands will boost product margins, especially once the company has worked through its national brand inventory, according to CFO Dan Jedda.

Another innovation that hasn’t panned out is the “Fix Preview.” This allows customers to accept or reject items before a human stylist finishes putting together a box of items, which theoretically makes it more likely the selections will be kept. Last year, then-CEO Elizabeth Spaulding said the feature was bolstering retention rates, though some stylists maintained that it confused and irritated some clients. This week, Lake said the company has “refined our point of view,” after finding that Fix Preview led many customers to quit.

“Although at the highest level, Fix Preview has demonstrated a positive impact on [average order value], digging into the data, we see a more nuanced story,” she said. “There absolutely are clients who significantly benefit from Fix Preview, but there are also clients for whom showing a preview actually increases cancelation.”

Executives don’t seem to suspect any tech vulnerabilities, as Lake emphasized the company’s data prowess. “While many companies may be starting to define an AI strategy, our company was built on data science from day one,” she said. “We've built technology and systems that leverage the best elements of human stylist combined with machine learning, and the billions of proprietary data points that we have around client and product interactions are rich, meaningful datasets that predict outcomes and help us to understand what clients need.”

But the company’s tech may have led to some of Fix Preview’s underperformance, especially if an algorithm-generated preview is sent to a customer before a human checks it, according to Kellogg’s Abdallah. Stitch Fix has previously said that various previews are devised by stylists, the algorithm or a combination.

“So the stylists work as safeguards. It’s likely that the AI algorithms are not good in making recommendations, which is probably what is driving the cancelations,” he said. “There are multiple reasons why an AI algorithm might be bad at recommending clothing items.”

The company is now eliminating the preview for some, but not others, “allowing those clients to enjoy the surprise and delight that we know those clients value, while allowing other clients to benefit from the agency of Fix Preview,” Lake said.

Stitch Fix does have strengths to work with, including a strong cash position after a recent series of restructuring moves. Outside of its Freestyle business, the markdowns that have dragged down results at other retailers aren’t a major problem. Fix clients tolerate full price because they’re looking to build a wardrobe for work or some other occasion, rather than for deals, executives said.

Established clients spend less than newer ones do as their closets fill up, however, they also said. That could affect not just the company’s topline, but also the quality of its algorithm, which executives see as another strength. Having to start over with new clients could engender what’s known as “the cold-start problem,” Abdallah said.

“This becomes a spiraling loop, in the sense that, to attract and maintain new customers, you need a great recommendation algorithm,” he said. “But to have a great recommendation algorithm, you need to have good historical data on your customers, so that it can truly understand the customers’ preferences.”