The tone for 2025’s holiday season was set early as forecasts for consumer spending predicted sales would grow healthily, even if underlying volumes didn’t.

Shoppers, already pushed close to their breaking point by months of inflation and tariff anxiety, entered the holiday season feeling cautious and price sensitive. They did still spend — despite a budget pullback from previous years — but many leaned on buy now, pay later financing to do so, which could have long-term implications in the new year.

Retailers weren’t going into the season at their best, either. Outplacement firm Challenger, Gray & Christmas warned in September that seasonal hiring could hit its lowest point since 2009 — and indeed, few retailers gave details on their hiring efforts throughout the quarter. Instead, job cuts continued to hammer the industry as retailers scrambled to adjust to a tariff-altered buying environment.

Still, there were bright spots. E-commerce, given renewed life thanks to AI-driven shopping experiences, was popular once again this year. And shoppers showed up for the season’s annual Black Friday rush, although many did so online instead of in stores.

As we kick off a new year, here’s a look back at some of the biggest trends that impacted the holiday season in 2025.

Value won

Despite warning signs for months that tariffs, inflation and consumer wariness were looming over the season, it now looks like retailers fared pretty well in Q4 and, therefore, the year.

“Holiday brought the cheer, tariffs have (so far) been manageable, stocks are rebounding, and, most importantly and likely going unnoticed, the majority of our coverage actually operates at, or close to, their Gross Margin peaks,” Guggenheim analysts led by Simeon Siegel said in a Dec. 9 client note.

Value — found at discount or off-price stores or via promotions elsewhere — has been the name of the game for consumers most of the year. That’s been true at the holidays, too, and will continue into next year, analysts say.

“The Costco Economy is a sign that middle class families feel squeezed,” Navy Federal Credit Union Chief Economist Heather Long said by email. “Inflation is ticking back up, and unemployment is rising. The middle class is still spending, but they are focused on the basics and little splurges. Larger tax refunds in 2026 will help in the spring, but it’s going to be a tough winter.”

How consumer fervor helped

Although consumers have been hesitant to open their wallets for discretionary items, many will do so — apparently gladly — for special occasions. In that way, Q4 holiday shopping was much like the rest of the year, according to UBS analysts, speaking at a Dec. 8 virtual press conference.

“It's mostly been a continuation of what we've seen throughout much of the last several quarters, which is the consumers coming out, shopping around key events, seeking out deals, and in between those key periods, retreating a bit,” UBS analyst Michael Lasser said.

Shoppers also seem to be segmenting purchases, UBS found. They bought Halloween costumes early and decor later, and in Q4, similarly bought core items early and decor closer to the holiday.

In fact, consumers pulled back on spending on decor and other lower-priority and/or disposable items like gift wrap and greeting cards, “where trading down is becoming more common,” according to a report from Colliers.

The intensity of holiday marketing and promotions could ultimately drive a record number of returns once the season is over. Marty Bauer, an e-commerce expert at customer-messaging platform Omnisend, said sales events like Black Friday and Cyber Monday drive impulse buying.

“When everything feels urgent (‘Only 2 left!’) shoppers are more willing to take chances, buying multiple sizes, colors, even brands they’re unsure about,” Bauer said by email. “Many of those orders end up going back once people realize the purchase was driven by the discount, not real need.”

An early kickoff to a season of deals

Retailers once again kicked off the holiday season early with sales events just weeks after summer officially ended.

Like years past, Amazon launched its Prime Big Deals Day event in early October, with others quickly following suit including Walmart, Target and Kohl’s.

While consumers always seek out deals at the holidays, economic uncertainty intensified this season. Inflation, tariffs and a government shutdown during the early holiday season sent consumer sentiment down, falling to the lowest point in three years in November.

Nearly three-quarters of consumers said they would be more selective in their holiday purchases, while almost two-thirds of shoppers said they’d spend more time looking for deals this year, according to an ICSC survey from October.

To entice consumers, Walmart hosted two Black Friday events, as well as a Cyber Monday event. And Amazon kicked off a nearly two-week-long Black Friday sale, featuring “millions” of deals.

Halloween: The holiday before the holidays

One big lead up to the season is a holiday within itself: Halloween.

Its increased financial prowess can’t be ignored. In 2025, spending was expected to hit a record $13.1 billion, according to the National Retail Federation, up about 13% year over year.

“Even with concerns about price increases due to tariffs, Halloween continues to resonate with consumers of all ages,” Katherine Cullen, NRF vice president of industry and consumer insights, said in a September statement.

Over three-quarters of adults celebrate and treat Halloween like an encapsulated version of the winter season, according to PwC. It also sets the stage for holiday merchandising as the emotional appeal and in-store experiences resonate with shoppers, particularly with Gen Z.

The tariff reaction from retailers and consumers

Tariffs swayed both the consumer and companies in 2025. While shoppers braced for higher prices, levies altered buying as brands ran into problems forecasting the cost of goods from suppliers.

The result was a consumer base that was actively looking for deals and for companies to provide value, in some cases willing to trade down to get a better price point.

Some retailers, on the other hand, have been able to mitigate tariffs’ impact. Off-price retailers in particular have been able to protect margins so far. Executives at Ulta Beauty recently stated that brands are continuing to be cautious about passing on tariff-related price changes to customers. However, the company saw more brand-driven price increases in Q3 compared to the previous quarter.

Retailers bet on nostalgia and freebies

In the face of a tough economic environment, retailers this holiday season leaned into the nostalgia of well-loved holiday characters, fresh experiential concepts and exclusive in-store perks.

Target brought back its “Hot Santa” fictional store team member named Kris K. this year, along with new cartoon-like holiday characters such as the Get-Ready Yeti and The Gifting Mice. Meanwhile, Walmart enlisted the help of actor Walton Goggins to portray the Grinch, the iconic Dr. Seuss character, for its “WhoKnewVille” holiday campaign.

Some retailers hosted holiday pop-ups and special experiences for customers. T.J. Maxx debuted a “Maxxinista Express” experience featuring a multicity holiday tour on a double-decker bus for superfans. Additionally, QVC held a two-day holiday pop-up in the Flatiron District of New York City designed as a reimagined version of Mrs. Claus’ house.

For Black Friday, Lowe’s and Target offered exclusive in-person giveaways to some of the first shoppers that day. Target offered a free limited-edition tote bag filled with giveaways to the first 100 guests in line while Lowe’s gave away a bucket with products to the first 50 customers.

Artificial intelligence grew to modest heights

This holiday season proved that AI is a growing presence in the retail world.

AI traffic to U.S. retail websites on Black Friday increased 805% compared to 2024, per Adobe Analytics data. Additional data from Salesforce found that $3 billion in U.S. online sales were driven by AI and agents during the important shopping day.

Retailers and tech companies rolled out a slew of AI-related features throughout the year, but some even debuted tools just in time for holiday shopping.

Google — which operates AI platform Gemini — introduced a suite of AI-powered shopping features ahead of the holidays. The launch allows U.S. Gemini app users to receive shoppable product recommendations, pricing and comparison tables. It also debuted a “Let Google Call” feature that will call local stores to verify product availability and more on behalf of users.

Meanwhile, OpenAI debuted shopping research capabilities for ChatGPT users in November. The tool is meant for more in-depth product research and the company said it made “nearly unlimited usage available to all plans through the holidays.”

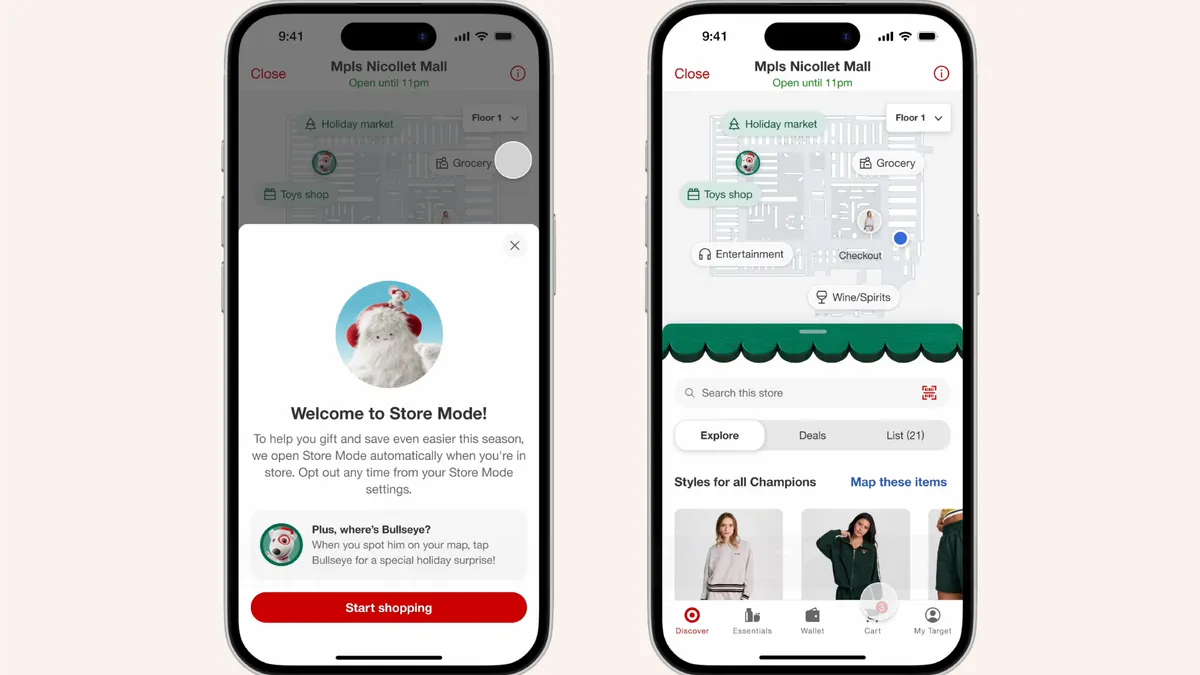

On the retailer front, Target launched a conversational AI-powered gift finder ahead of Black Friday, which gives consumers gift recommendations based on details such as the age and special interests of recipients.