In terms of sales, last year was a much better holiday than most predicted. Tepid expectations for the season gave way to 8.3% growth, according to the National Retail Federation. But it wasn't a particularly joyous season, with many concerned for the health and safety of their families as the pandemic raged across the U.S., and the world waited for vaccines to become available.

Shoppers stayed home in large droves, buying holiday gifts online instead, and retailers tried to encourage safe buying behavior through curbside pick-up options and other conveniently distanced methods of purchasing. Retailers reimagined traditional holiday activities virtually, and customers accepted things were going to be a bit different than usual.

This year, there are signs of a return to (somewhat) normal. Macy's Thanksgiving Day Parade is allowing spectators once more. The department store's Santaland is back, offering children the chance to share their lists with Santa Claus like years past. And yet, it's still not quite like years past. The pandemic is still with us, and the delta variant has raised consumer concerns as shoppers prioritize staying safe.

"For retailers hoping for a return to the good old days of 2019 we have a double dose of bad news," Alvarez & Marsal wrote in a consumer sentiment report this October. "Not only is consumer spending muted but the changes in shopping behaviors — brought about by Covid and fears of social contact — are here to stay."

Most (85%) of shoppers are intending to either continue or accelerate the shopping behaviors they picked up during the pandemic, including BOPIS and curbside, the firm found. That leaves just 15% that expect to "fully revert" to their old shopping habits. That could mean more e-commerce once again, which grew massively for most retailers last year as consumers stayed cloistered in their homes.

And many consumers are still concerned about their finances as well. Alvarez & Marsal found that "overall consumer optimism is weak," with about 58% of shoppers expecting their family's financial situation to either stay the same or worsen in the next six months.

With the pandemic still haunting the public, and financial concerns hanging over consumers' heads, it's hard to say whether the "joy" of the season will return this year. There are some signs, at the least, that it won't be as disrupted as last year.

"Right or wrong, there's a certain sense of security among us. Those that are vaccinated feel a little more confident in getting out," Brendan Witcher, vice president and principal analyst at Forrester, said. "All you have to do is go to any shopping mall, even now, ahead of the holidays, and you're going to see that people are out, they're shopping, they're buying, they're spending time in stores."

'No one wants Santa to be a superspreader'

With vaccines becoming widely available in the U.S. this year, the holiday season will, in some ways, be very different than last year's, when the threat of a pandemic surge kept many shoppers home instead of visiting family or out in shopping centers. But the behaviors consumers picked up during the pandemic haven't necessarily left, and health concerns are still dogging consumers.

Alvarez & Marsal's recent study found a third of respondents cited health concerns as a reason they wouldn't be shopping as much as they might like to, while a recent U.S. consumer sentiment report from McKinsey found a majority of shoppers were growing wary once more of out-of-home experiences and embracing the "homebody economy."

Shopping in stores is still causing anxiety for 40% of shoppers, according to a recent Deloitte report, though that is down 11 percentage points from last year. And some are predicting that e-commerce will rise once again this year, despite huge growth in e-commerce last year.

In that environment, retailers are tasked with not just creating holiday experiences, but ensuring they feel safe enough for shoppers to participate. Hence, why even though Macy's Santaland is technically back, kids won't be invited to sit on Santa's lap this year. They'll be sharing their Christmas lists from six feet away.

"Sitting on Santa's lap is maybe an iconic part of visiting Santa, but it's [also about] stepping into that space that's decorated, has a tree, has some snow, has some presents, has the music — and all of those things can come back."

Karthik Easwar

Associate Teaching Professor of Marketing at Georgetown University

"No one wants Santa to be a superspreader, right? That would be probably the worst headline of the year," Witcher said, noting the precautions are smart on Macy's part.

The sight of masks on shoppers or volunteers might be a reminder of the pandemic, but most consumers are so used to them that they're relatively invisible and likely won't impact the enjoyment of the event much, according to Witcher. The cheer and overall excitement of visiting Santa is also about more than just the opportunity to pose for a photo.

"Sitting on Santa's lap is maybe an iconic part of visiting Santa, but it's [also about] stepping into that space that's decorated, has a tree, has some snow, has some presents, has the music — and all of those things can come back," said Karthik Easwar, associate teaching professor of marketing at Georgetown University. "Even if you're standing six feet from Santa, telling him what you want for Christmas."

To Easwar, these kinds of precautions around traditional holiday events allow shoppers to, by and large, return to their usual family traditions, even if they only get "90%" of the experience back. Compared to last year, 90% is a lot.

Lauren Bitar, head of insights at RetailNext, pointed to the ability to control occupancy as another way to adapt holiday experiences to a year still partially impacted by the pandemic. That not only prevents stores from being overcrowded but also helps associates to "better control the experience" during a labor shortage that's making it difficult for retailers to find workers.

The amount and level of precautions may also depend on what other retailers are doing about a certain issue. Consumers and retailers both tend to operate based on crowd wisdom around the pandemic, according to Witcher, and that will likely continue, with retailers adding or axing precautions as others in the space do.

"I would not be surprised if we see the trends to outdoor holiday experiences increase — and I'd say that's twofold," Easwar said. "One, it gives a level of comfort or safety to the experience that it is outdoors instead of indoors, that you might be able to space out a little bit more than you would in a confined space. I think the other side of it is, broadly speaking, a lot of people have been cooped up for 18 months, so just being outdoors is nice."

Will cheer be back in holiday marketing this year?

Outside of navigating in-person activities, retailers will have another difficult year of striking the right tone through their marketing. The pandemic isn't gone, but the U.S. is not in the same place it was last year with fears of COVID-19 running so high that the usual cheerful holiday marketing felt out of place. McKinsey's recent report on consumer sentiment found that overall optimism regarding COVID-19's impact has increased this year, but pessimism has also edged up. In August this year, 43% of respondents expressed optimism about the U.S. economic recovery after COVID, while 16% expressed pessimism and 41% had mixed feelings.

"Last year was really important to not be tone-deaf to the situation," Witcher said. This year, however, will be different, with brands perhaps encouraging alternate channels like BOPIS and curbside rather than necessarily acknowledging the pandemic. "That's a smart move because it's saying that the pandemic is still here, but it's not [explicitly] saying the pandemic is still here. Because it's not obvious to the consumer that I'm being told to use buy online, pick up in store or curbside or ship-to-home for the pandemic. I'm getting told that, well, just because."

Another slightly more covert message this season may tie into the supply chain. Retailers have already begun pushing consumers to shop earlier this year, and the full extent of supply chain challenges has become so well-known that consumers are even anticipating stockouts. Even so, retailers can be smart about what they're promoting to consumers without necessarily spelling out their challenges to shoppers.

Encouraging consumers to shop early will allow retailers to gain insight into trending products to place their final orders early this year, according to Witcher, and store-wide discounts or category-wide discounts will allow retailers to offer promotions without running into inventory shortages. In anticipation of inventory challenges, Bitar expects the sense of urgency in holiday ads to accelerate this year as well.

"There's always that in the holidays anyway, but this season it's like: 'This is going to fly. We don't have a lot of it. Start your shopping now,'" Bitar said. "It's very much like they're riding the line they always love, which is 'Get it now before it's gone,' but to the umpteenth degree."

Some retailers are also returning to more merry marketing initiatives. Nordstrom in October announced its holiday campaign, "Make Merry," which "was inspired by the happy, sometimes hilarious mid-revelry moments that turn the season into a celebration." The campaign shows families and friends "experiencing real joy and connection" by being together.

"Remember those amazing things we used to do from, you know, forever until 2019? Let's get that back this year."

Karthik Easwar

Associate Teaching Professor of Marketing at Georgetown University

Neiman Marcus is likewise centering on the "sentiment of celebration and cheer" with its holiday campaign, "Celebrate Big, Love Even Bigger." Chief Merchandising Officer Lana Todorovich specifically noted that consumers would be "celebrating in person again" this year with friends and family, and the campaign video is focused on love and togetherness.

Add J.C. Penney, too, to the list of retailers reaching back for joy in holiday marketing. The department store describes its holiday campaign as centering on "time with family and friends and sharing joy with others." The ad will emphasize "the simple joys" of special moments with friends and family.

Last year, campaigns like these may not have been appropriate. But this year, Easwar says these types of holiday ads may be more prevalent as retailers try and remind shoppers of what things were like before the pandemic.

"Remember those amazing things we used to do from, you know, forever until 2019? Let's get that back this year," Easwar said. "And I think that's a slightly different message than you've generally seen in the past where it always felt like, 'Here's the exciting new thing.'"

Is e-commerce 'divorcing the experience' from holiday gift buying?

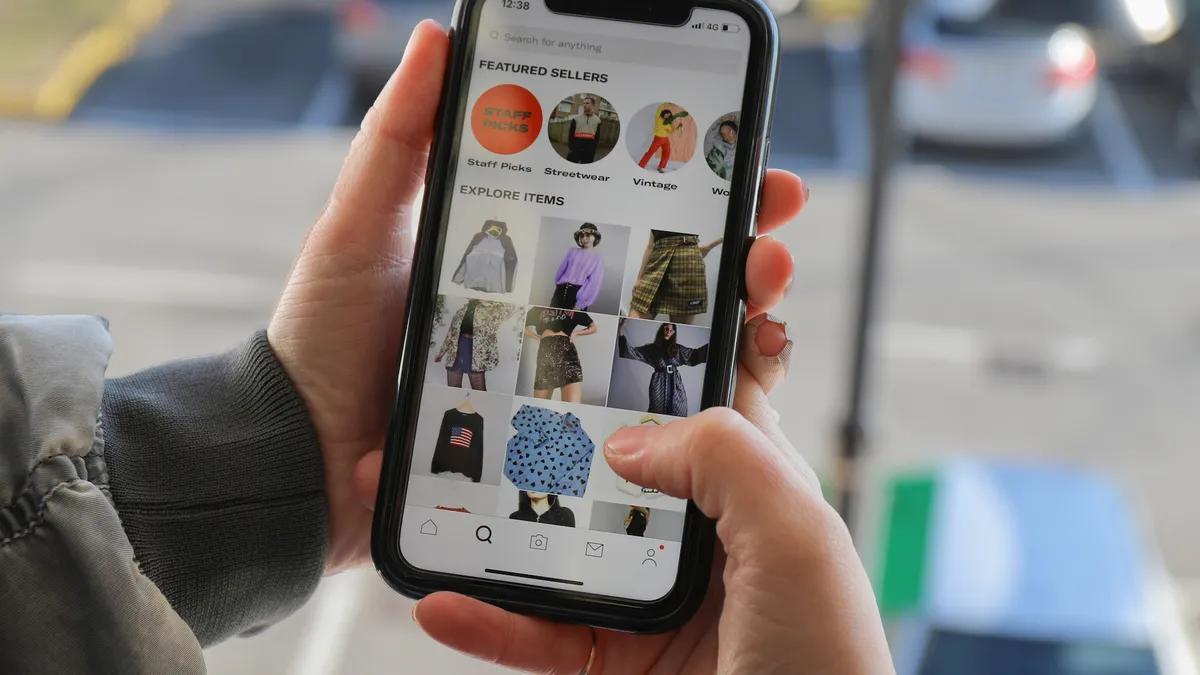

Some of the excitement of the holidays may be returning this year, but with shoppers shifting more spending to e-commerce long term, is the fun of holiday shopping at risk of being lost? According to McKinsey, stores saw 5% growth in August, but e-commerce sales have continued to rise strongly, with 30% growth in the same period. Around 60% to 70% of shoppers buy or research both online and in stores, according to the survey, and online penetration is approximately 30% higher than pre-COVID.

Alvarez & Marsal sees the interest in e-commerce as not necessarily threatening to stores, provided retailers invest in them. Like McKinsey, the firm found that omnichannel shopping was popular and physical stores "still reign supreme" during the actual purchase. Online channels were more useful prior to and after purchasing.

As e-commerce rises, though, there's the potential for a vicious cycle to hit retailers, according to Easwar. Retailers are creating systems for product delivery and other conveniences to address the popularity of e-commerce, which also means consumers don't feel the need to visit stores as much.

"So stocking the store makes less sense, which makes the value of going in store to explore products less valuable, which then pushes me online to shop, which then makes the store less valuable," Easwar said.

Offering e-commerce and easy pickup options like curbside are great for convenience, but they also in some ways "detract from that communal holiday experience," according to Easwar. The result is that what used to be one experience — shopping for the holidays while enjoying the sights and sounds associated with the season — has become two: The task-oriented shopping for the season and the more experiential enjoyment of the holiday environment.

"We want to feel like things are going back to normal and the way we do that is to do things we did before the pandemic."

Brendan Witcher

Vice President and Principal Analyst at Forrester

"Now, I shop on my phone on maybe Thursday night while I'm just watching TV. And Saturday, I go to a holiday market where it's not to come away with things but it's to be in that space, drink a hot cocoa or a mulled wine, hang out with a couple friends, walk around, see the decorations and come home with nothing necessarily in a bag," Easwar said. "It's almost divorcing the experience from the goods and services you're purchasing and getting those in different ways."

The perpetual rise of e-commerce will only exacerbate that issue as customers turn to delivery and convenient pickup options instead of their usual store visits. But even with most projections including a rise in e-commerce once again this year, Witcher thinks that the reverse will happen.

"We want to feel like things are going back to normal, and the way we do that is to do things we did before the pandemic," Witcher said. "We're almost trying to will it to happen. By getting out, the virus is going to notice we're getting out, and it's going to give up, right?"

Simultaneously, Witcher expects that as shoppers potentially step back into stores this fall and winter, retailers will likewise step back from offering services like curbside. He pointed to Costco, which should be "the poster child" for curbside, as a good example. After finally introducing a pilot of the service, the wholesaler discontinued it because it hadn't gained much traction, according to executives. Witcher thinks this is because when shoppers enjoy a retailer's experience, they'll want to shop in the store, not pick up something curbside.

"We don't really need curbside. In most cases, if we leave the house that means we want to get out of the house and not sit in our cars," Witcher said. It's also more costly for retailers than having shoppers come into stores themselves. "I'm encouraged when I see curbside spots being the only open spots in a mall. I like that, and the reason I like that is because it shows that consumers are dedicated to shopping."

E-commerce and convenient fulfillment options were necessary during the height of the pandemic last year, but long term it may be a better sign for the "fun" of shopping if customers return to physical stores. The separation of gift buying from the experiential elements of the season does give customers the option to choose when they just want to buy products and when they want to have a more full holiday experience, Easwar said, but in terms of the overall season, that could be more harmful than helpful.

"We should be able to say that a task can have some function and some entertainment together. That's what living is, it's not picking when you want to be productive and picking when you want to be entertained, it's going out and doing things and experiencing a mix of entertainment and function together," Easwar said. "And there's a philosophical side of me that says that is actually preferable as a human experience than this more economically efficient, as you might think of it, experience that I think we're starting to craft more of."