Dive Brief:

- In order to focus on its core marketplace, Etsy is selling apparel resale site Depop to eBay for $1.2 billion in cash. Etsy acquired Depop nearly five years ago for over $1.6 billion.

- The deal is expected to close in the second quarter, subject to regulatory approval and closing conditions, the marketplaces said in a joint press release Wednesday.

- Last year, Depop’s gross merchandise sales reached $1.1 billion, up from $789 million in 2024. The site’s lower adjusted EBITDA margins were a 350 basis-point drag to Etsy’s overall adjusted EBITDA margins, executives said during a Thursday call with analysts.

Dive Insight:

Depop is the second acquisition that Etsy is walking away from — the maker marketplace sold musical instrument site Reverb last year after running it for six years.

“With the excellent offer presented to us by eBay, and in light of the significant opportunity we see at Etsy, we made the decision to sell Depop and fully prioritize our core marketplace,” Chief Financial Officer Lanny Baker told analysts Thursday morning. “We believe that obtaining a strong value for Depop now and focusing on Etsy, where we believe we can achieve a higher rate of return on invested capital, will best enable us to maximize shareholder value in the long term.”

Proceeds from the sale will go toward general corporate purposes, share repurchases and investment in the Etsy marketplace, Baker said.

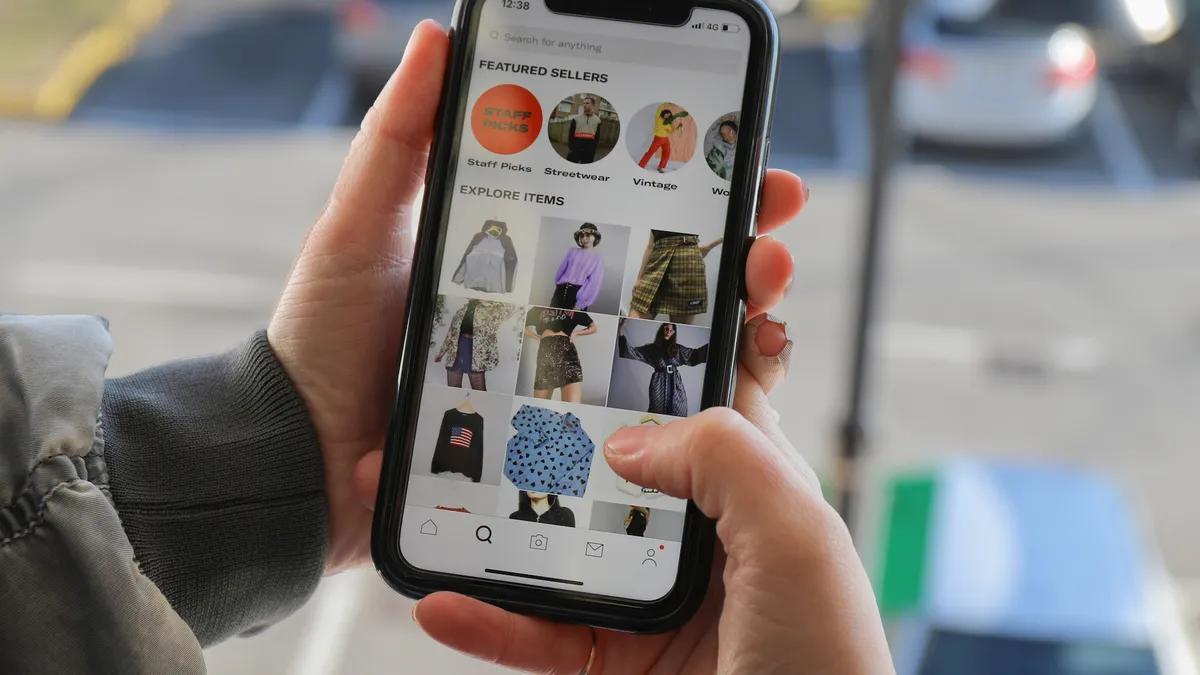

U.K.-based Depop, whose largest market is now the U.S., is popular with Gen Z and millennial consumers. Depop’s U.S. sales grew 60% last year, the companies said.

Etsy would like to see those younger cohorts at its core marketplace in greater numbers, according to CEO Kruti Patel Goyal, who led Depop for Etsy before taking the chief executive role in the new year.

“We've seen our buyer demographics aging, with older users growing faster than younger ones,” she said. “Our research shows that's not an appeal problem, it's a presence gap. Hence, our work to improve our app and shift our marketing mix to more intentionally engage and acquire younger shoppers.”

Depop’s move to eBay will likely be a boon to both marketplaces, as long as eBay keeps Depop independent, according to GlobalData Managing Director Neil Saunders.

“Adding Depop is very accretive to eBay, and it also gives the firm a new growth vector that will help satisfy investors,” Saunders said in emailed comments. “However, it also helps eBay to future-proof itself by being able to compete more effectively with the raft of fast-growing secondhand apparel sellers.”

Thanks to eBay, Depop is also poised to benefit from the “technology, investment, and infrastructure that it sometimes lacked when it was part of Etsy,” he also said.

“In this sense, Depop is now part of a group that can support it more effectively,” Saunders said.

Apparel is already a major source of growth at eBay. Last year fashion “generated well north of $10 billion” in gross merchandise value globally, eBay CEO Jamie Iannone told analysts Wednesday. Depop sellers and buyers will have access to eBay services, including financial services, shipping, cross-border trade solutions and its authenticity guarantee, Iannone also said.

Chief Financial Officer Peggy Alford said the company plans to “invest in Depop to support future growth and synergies between our respective marketplaces.” Early on, eBay expects there will be a low-single-digit headwind from Depop to the 8% to 10% operating income growth it had forecast for its core marketplace, based on Depop’s current operating profile plus expected integration costs and planned investments, Alford said. But eBay expects the acquisition to be accretive to non-GAAP operating income in two years.