It’s been another week with far more retail news than there is time in the day. Below, we break down some things you may have missed during the week and what we’re still thinking about.

From consumer spending forecasts to Playboy energy drinks, here’s our closeout for the week.

What you may have missed

Levi’s brings Target vet on board

Levi Strauss & Co. appointed Jeffrey Jones to its board, effective Jan. 21, the company said in a Tuesday announcement. Jones will serve as a member of the board’s nominating, governance and corporate citizenship committee as well as the compensation and human capital committee.

Jones has been the CEO of H&R Block since 2017 and will retire from the company on Dec. 31. Jones was previously the chief marketing officer at Target, where he oversaw brand, digital and guest experience strategy, along with investor relations, among other efforts.

“Mr. Jones brings extensive experience in consumer insights, brand building and organizational transformation and has a proven record of creating significant stakeholder value,” Levi’s Board Chair Bob Eckert said in a statement. “He has repeatedly strengthened brands and organizations across industries, and his leadership will play a critical role as we evolve LS&Co. into a best-in-class, DTC-first retailer.”

The Athlete’s Foot steps into e-commerce in the US

The Athlete’s Foot has launched an e-commerce platform in the U.S., over 50 years after operating as a global brick-and-mortar retailer.

The sneaker and streetwear retailer said that up until this point, its U.S. presence has been focused almost exclusively on physical retail.

“This launch extends that experience nationwide for the first time, allowing the brand to reach consumers well beyond its existing store footprint,” the company said in an announcement emailed to Retail Dive.

The move is intended to grow its footprint, reach new customers and make its product offerings available in a “broader, more modern shopping journey.”

The chain currently operates over 400 stores worldwide.

Retail therapy

Playboy debuts energy drinks

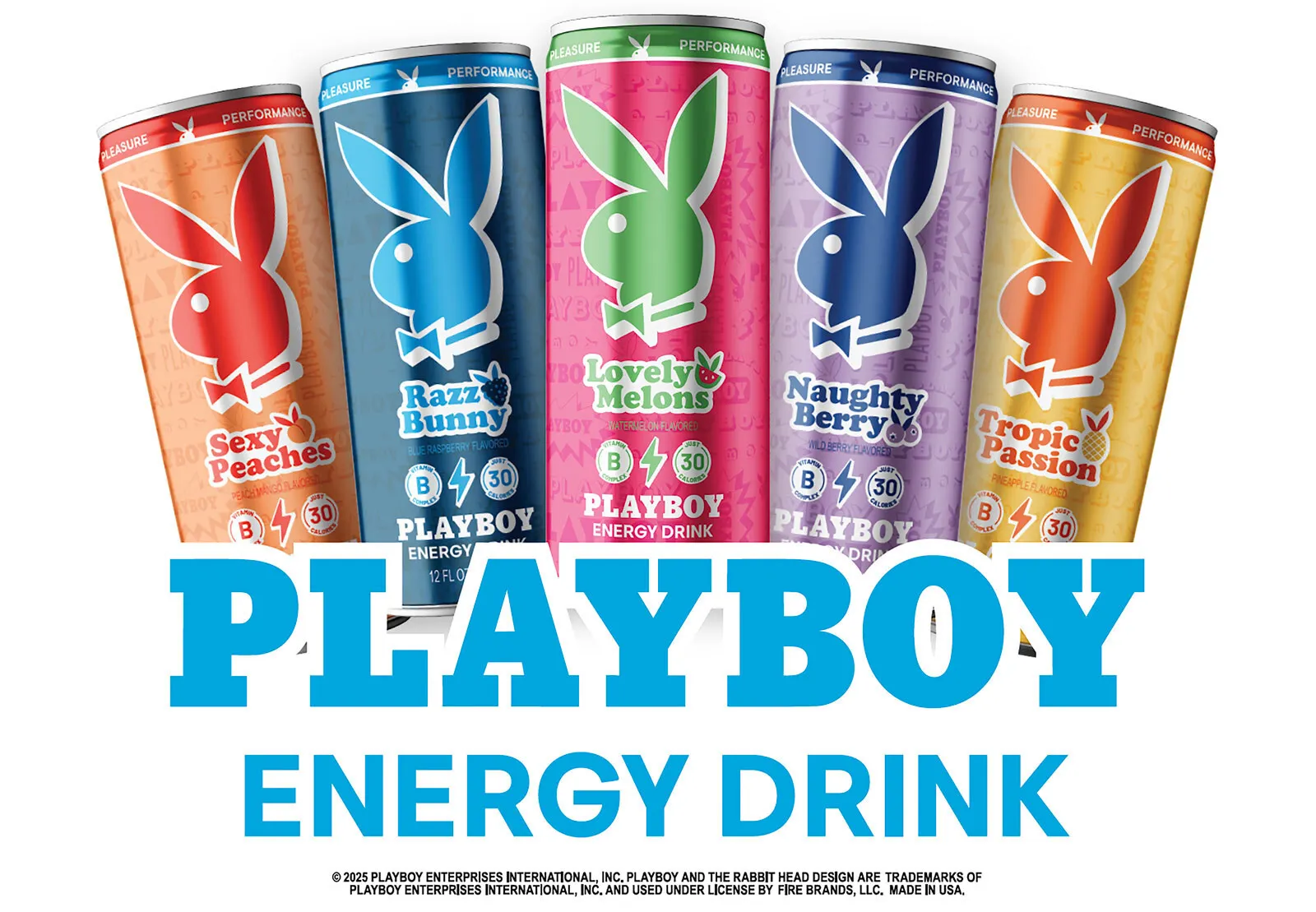

Beverage company Fire Brands partnered with Playboy on a new line of energy drinks that feature the iconic Playboy rabbit head branding, per a Wednesday press release.

The Playboy Energy Drink includes 200mg of caffeine with 30 calories and comes in five lightly sparkling flavor options.

"Playboy is an iconic symbol of fashion and pop culture," Lori Cowley, director of product development at Playboy, said in a statement. "Playboy Energy pairs vibrant packaging with a performance blend made to inspire and energize the next generation of creators and tastemakers."

What we’re still thinking about

1.5%

That’s about how much Moody’s Ratings analysts, led by Claire Li, think consumer spending will grow next year. This is a slowdown — from 2.5% growth in 2023 and 3% in 2024 — that isn’t dire for the overall economy but will hit retail especially hard. The analysts, like many others, believe that value-oriented stores will continue to attract market share as a result, as they have during the holiday season.

Rising unemployment and ebbing wage gains — along with increases in costs like healthcare and childcare — are to blame, per the report.

“Momentum is fading for consumer spending growth as softening labor conditions and other late-cycle pressures increase,” they said.

What we’re watching

Who’s winning running shoe sales this season?

We won’t know how well many retailers did this holiday season until early next year, but there are some early reads on what’s been selling with consumers.

According to analysts at Guggenheim, On and Hoka were “standouts” during the Black Friday and Cyber Monday period. The two footwear retailers saw notable increases in sell-out percentages across the styles Guggenheim tracks, according to a Tuesday note led by Simeon Siegel.

Specifically, On’s sell-outs improved by 650 basis points during the Black Friday week period, while Hoka’s grew by 550 basis points. The popular shopping period also revealed a bright spot for Nike’s running business, which improved 380 basis points thanks to strength in the Vomero franchises.

“Nike’s Run category growth has accelerated in recent quarters, and we believe growth has benefited from Nike’s realignment of the category late last year,” Siegel wrote. “Critically, this year’s launches are showing signs of scaling, giving us confidence that Nike’s Run category can continue to grow in coming quarters.”