Department stores once owned the holidays, staging celebrations that seemed above the sales hustle while simultaneously making the season lucrative for themselves.

These days the holidays own them.

Department stores aren't alone in their dependence on the fourth quarter; the period is critical for many, if not most, retailers. And they remain popular on Black Friday: The National Retail Federation this year found that half of the 189.6 million who shopped during that five day shopping weekend visited a department store.

Lately, however, the dawning of a new year has brought with it bad news for the segment, with evidence they once again missed expectations and ceded share to discounters and off-pricers. Holiday 2019 is setting up 2020 for more of the same.

"We foresee a highly promotional holiday environment that retailers should be prepared for given a tough 3Q particularly for women’s apparel and mall and department store retailers," Cowen & Co. analysts, led by Oliver Chen, wrote in a Nov. 22 client note. They also mentioned how mass merchants like Walmart and Target are increasingly winning, while "apparel-driven retailers" like Kohl's, Macy's and Gap Inc. underperform.

So far, 2019 has been a mixed bag for the likes of J.C. Penney, Macy's, Kohl's and Nordstrom, making the holidays a key time once again, a mad rush this year with six fewer shopping days. A few clues to the sector's fate this season can be found in third-quarter reports, along with some data trickling in from Black Friday weekend.

J.C. Penney

J.C. Penney surprised many with a third quarter that included a net loss narrower by a third, better than analysts had expected, and much improved margins despite a hefty sales decline. That sounds like good momentum, but the retailer remains hampered by problems left mostly unsolved by stop-and-go turnarounds under four CEOs since 2013.

The latest, Jill Soltau, seems to be embracing ideas from former Apple store guru Ron Johnson, who was abruptly fired from Penney in 2013 for making changes the board deemed too drastic. Now drastic change is exactly what the place needs. "If you’re a young person, you’ve never been in a Penney's," Lee Peterson, executive vice president of thought leadership and marketing at WD Partners, told Retail Dive in an interview. "The smartest thing they ever did was bring in Sephora — but that was like sticking a thumb in the dike — they could have done a lot more than that a long time ago."

Among Soltau's moves is a new "brand-defining store," being piloted in Texas, which is capable of boosting traffic, conversion, sales, margins and volumes, "making it a much more efficient and effective retailer," according GlobalData Retail research. But a national rollout would be time-consuming and costly, warned GlobalData Managing Director Neil Saunders in emailed comments, adding that some locations wouldn't see such benefit because the malls they're in are declining.

Some analysts think that a bad holiday performance by J.C. Penney could usher in the kind of slow but inexorable decline seen at Sears; at the very least, it will likely mean a shrinking footprint. "If tougher US holiday trends materialize, we still see rising risk of another round of large scale store closures for JCP ... or worse," Credit Suisse analyst Michael Binetti said in a Nov. 15 client note.

Macy's

With its Thanksgiving Day parade, Macy's kicks off the holiday season for everyone. But the department store's third quarter siphoned a lot of air out of its own holiday hopes, with topline and comp declines and shrinking profits. Comps fell 3.5%, with a 30 basis point drag coming from stores in lower-tier malls. That led CEO Jeff Gennette to hint there could be store closures in 2020, a departure from the retailer's assertion earlier this year that its two-year, 100-store reduction was complete.

Cowen & Co. in a Nov. 21 client note listed "store footprint & service levels, speed, and women’s apparel" as structural concerns and said they were keeping an eye on Macy's "holiday execution."

The department store appears to be taking no chances, and led apparel retailers in slashing prices over the Black Friday period, according to a report from Dataweave emailed to Retail Dive. Macy's average markdown was 29.5%, on 41% of its top product listings, and Macy's-owned Bloomingdale's was second with an average 24.5% markdown on 10% of its top products. Understandable, perhaps, considering how off-price retailers have grabbed Macy's share for years now.

GlobalData Retail analysts found some optimism for Macy's holiday quarter, but mostly because last year's numbers will be fairly easy to top. "However, we do not expect the chain to be a big winner," Saunders warned. "The holiday magic that drives sales was lost a long time ago, and Macy’s has consistently shown a lack of interest and willingness in reviving it."

Kohl's

Located mostly in strip centers, which is sparing it the trouble befalling malls, and with a slew of new efforts, Kohl's has seemed well-positioned to escape the issues dogging other department stores. But it's not entirely turning out that way.

"We thought [Kohl's] would fare better than weaker industry trends considering a meaningful number of new initiatives," Credit Suisse's Binetti said in emailed comments regarding the retailer's third quarter. During the holiday months, the retailer should have the benefit of its Amazon returns program now that it's in all stores, "a record level of newness" thanks to new brand collaborations and partnerships, plus other new marketing and merchandise.

The company's stores may not be in the best shape to take advantage of the retailer's Amazon partnership, however. In fact, while many see Target dominating department stores thanks to its lower prices and broader assortment, retail consultant Sanford Stein, author of "Retail Schmetail," says it's also besting Kohl's and others when it comes to merchandising.

"Target recognizes that it's necessary to create an experience, compared to what Kohl’s is trying to do, in just selling goods," he told Retail Dive in an interview, describing the two retailers' contrasting approaches to their recent "Frozen 2" displays. "It speaks to why Target continues to take share and why Kohl’s is in a constant fight for its life."

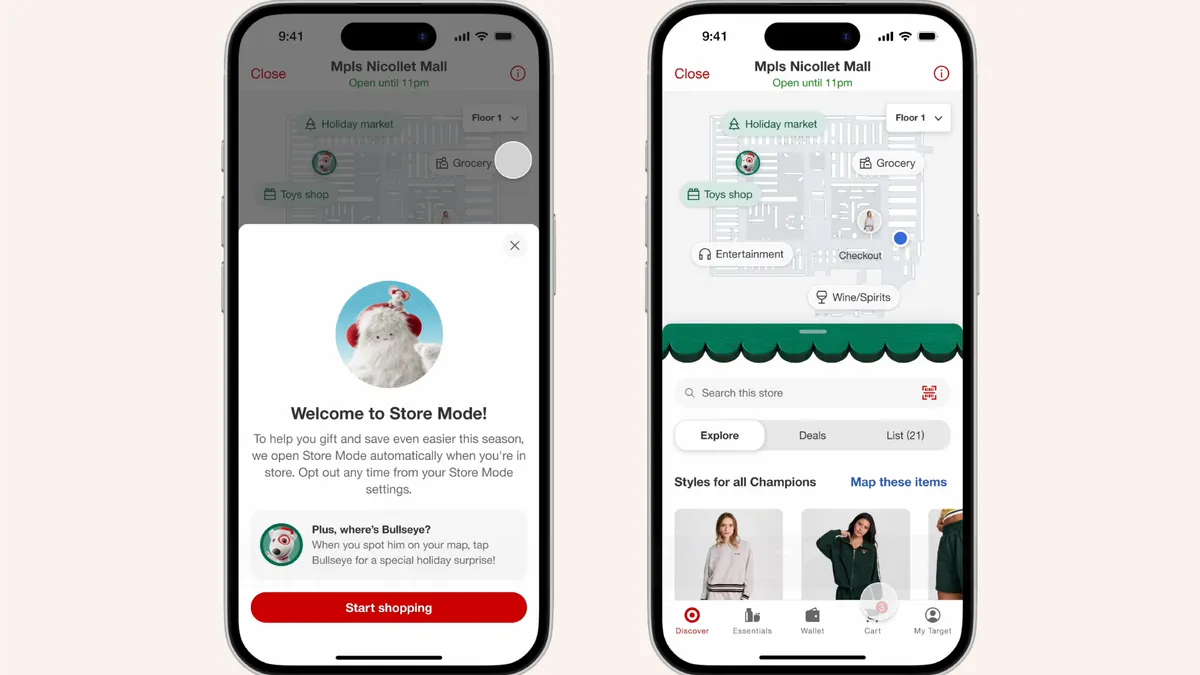

Kohl's customer experience is better online and through its shopping app than at its stores, according to analysts at Jane Hali & Associates. That could be something of a boon this year, considering how many shoppers have turned to mobile to get their holiday shopping done.

Nordstrom

Credit Suisse took the occasion of Kohl's and Macy's third-quarter reports to worry about the department store sector as a whole, calling them "a sobering referendum for holiday 2019."

But Nordstrom swooped in later that week with expectation-busting results in its quarter.

To be fair, the retailer no longer reports store comps, which executives say is to account for surging digital sales — but which some analysts, including GlobalData Retail's Saunders, believe reflects consistent underperformance in that metric. In any case, the company did protect its margins, with what Wedbush analyst Jen Redding deemed "impressive expense management & inventory control." That, plus Wedbush's finding of less promotional activity heading into the season than last year, signaled "momentum building into Holiday," according to a Nov. 22 client note.

Such avoidance of promotions is an outlier in a year when several retailers are leaning on discounts to lure shoppers. It seems to be paying off for Nordstrom so far. Edison Trends, in a breakdown of Thanksgiving-Black Friday e-commerce spending by retailer, found that Nordstrom, with a 60% rise, and Walmart, with a 53% increase, saw the biggest year-over-year spending gains, followed by Amazon with a 49% increase. Nordstrom also saw a $17 increase in average online order value, second only to Best Buy's $18, (and besting Walmart's $11 and Amazon's $4, and declines at Etsy, Kohl's, Macy's, eBay, Target and J.C. Penney).

Other 2019 quarters have been less kind to Nordstrom, but it boasts some strengths uncommon in other department stores. While some analysts believe it may have to shutter some locations, for example, it's unlikely to face the level of downsizing that Macy's or Penney may have to contemplate next year. It never expanded drastically, and its flagships are mostly found in better malls and city centers, including its brand-new New York City store.

The department store is moving away from the pack in a few other ways, including by investing in cutting edge retail concepts, like its merchandise-free Local stores (now in expansion mode to more cities in time for holiday shopping) and Stitch Fix-like "Trunk Club" subscription styling service. Nordstrom has also succeeded in forging partnerships with some of digital retail's cult favorites, like Rent the Runway and, most recently, Glossier.