Dive Brief:

- Walmart Inc.’s fourth quarter revenue grew 5.6% year over year to $190.7 billion and operating income improved 10.8% to about $8.7 billion, per a Thursday report. Net sales increased 5.6% to nearly $189 billion for the period.

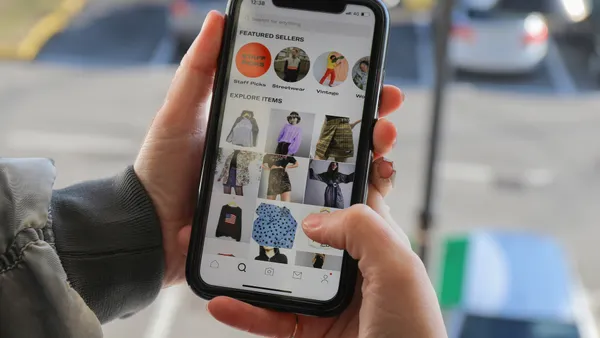

- Fourth quarter global e-commerce sales grew 24%, mainly due to store-based fulfillment and Walmart’s third-party marketplace. For the Walmart U.S. segment, which doesn’t include Sam’s Club, net sales jumped 4.6% to $129.2 billion and comps were about flat year over year.

- The retailer’s revenue for the full fiscal 2026 year increased 4.7% to $713.2 billion while net sales grew by the same percentage to $706.4 billion. Walmart Inc. expects fiscal year 2027 net sales to grow in a range from 3.5% to 4.5% on a constant currency basis. Operating income is expected to grow between 6% and 8%.

Dive Insight:

John Furner officially took on the CEO role earlier this month and stepped into the spotlight Thursday during his first earnings call as chief executive.

General merchandise sales grew globally and by low single digits for Walmart U.S., with fashion being a bright spot in stores and online, Furner told analysts on the Thursday call.

The quarter also continued to build on existing consumer trends related to household income.

“Again this quarter, the majority of our share gains came from households making more than $100,000,” Furner said. “For households earning below $50,000 we continue to see that wallets are stretched and, in some cases, people are managing spending paycheck to paycheck. That said, even these households are emphasizing convenience nearly as much as price.”

Furner in recent months has repeatedly beaten the drum on how AI will change the retail industry. Customers using the retailer's AI assistant Sparky have an average order value that’s about 35% higher than non-Sparky customers, according to Furner.

Industry analysts called out the retailer’s forward-looking guidance as being more conservative than expected.

“Overall, while we expect the below‑consensus outlook to create near‑term stock pressure, we believe Walmart remains well positioned heading into [FY27],” Jefferies analysts led by Corey Tarlowe said in a note Thursday. “The company’s balanced growth algorithm, improving earnings quality, and multiple self‑help levers underpin our view that the recent sell‑off represents an attractive entry point for investors.”

Walmart is overall “constructive on the economy,” but the company is taking into consideration economic indicators — such as a hiring recession and student loan delinquencies — when taking a more balanced approach to forward guidance, CFO John David Rainey told analysts.

“Despite offering a conservative forecast, Walmart is in good shape for the year ahead,” Emarketer senior analyst Rachel Wolff said in emailed comments Thursday. “Its efforts to upgrade and expand its assortment, as well as speed up delivery, are winning it e-commerce share and greater loyalty from higher-income shoppers.”