Dive Brief:

-

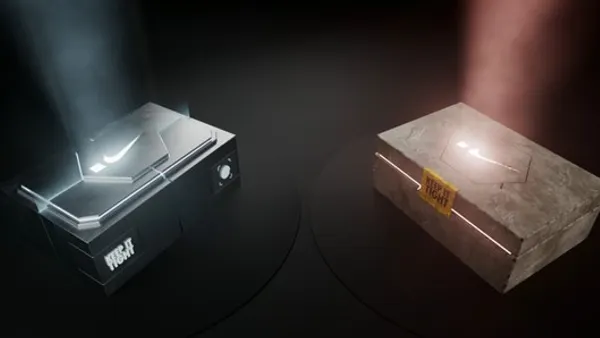

Amazon is planning a two-story, automated grocery store staffed primarily by robots, a model that would minimize human staffers to just three associates per floor and eliminate cashier responsibilities (translating to operating profit margins in excess of 20%), the New York Post reports.

-

The Amazon prototype store's top level would install robots to pick out goods to bring to shoppers, while the lower floor would offer produce and other items that consumers tend to prefer to choose themselves, sources told the Post. The store could also include a pharmacy and other features.

-

The store concept would support a maximum of 10 employees at any given time — for example, a manager whose responsibilities would include signing up customers for Amazon Fresh grocery delivery and other services, as well as staffers assigned to restocking shelves and facilitating drive-thru order pickups. “We have no plans to build such a store,” an Amazon spokesperson told the Post.

Dive Insight:

If true — which Amazon insists that it’s not — such a move (or something close to it) would continue Amazon’s penchant for automating tasks that are more efficiently and profitably completed by robots. Robotic fulfillment has become increasingly entrenched in Amazon’s e-commerce operations since the e-commerce giant bought warehouse technology company Kiva Systems Inc. in 2012, and the retailer is also testing a convenience store, Amazon Go, that eliminates friction by automatically checking out shoppers’ purchases via mobile application as they exit the store.

“The consumer does not need human assistance at checkout. You don’t need cash or credit cards, just your phone and an Amazon account,” Nels Stromborg, executive vice president of Retale, a location-based shopping platform aggregating weekly circulars from over 110 top retailers for mobile and digital devices, told Retail Dive earlier this year. “You take the things you want, walk out of the turnstiles and go. The experience is more efficient.”

As with its experiments with drone delivery and its deployment of robots in fulfillment, a move to leverage robots in stores not only helps Amazon drive down friction for its customers but also slashes a major expense in physical store operations, says Profitero VP of strategy and insights Keith Anderson. “It’s evident to me they’re thinking hard about how to solve some of those cost drivers,” Anderson told Retail Dive.

However, the increased use of robots is coming under scrutiny by economists, who are debating its long-term effect on employment. Perhaps to assuage fears that workers will be displaced by its own fleet of robots, Amazon last month announced that it will add some 100,000 full-time, full-benefit jobs in Texas, California, Florida, New Jersey and “many other states across the country” over the next 18 months on top of the 150,000 U.S. jobs the company has added over the past five years.