Editor's note: The following is a guest post from Bill Kearney, managing director of White Oak Commercial Finance. Views are the author's own.

What a difference a year makes. In 2020, many players in the retail sector had a near-death experience as a result of the pandemic. Today, retail is booming, riding a wave of pent-up consumer demand. The head-spinning turn has taught retailers some important lessons. They learned what it took to survive a crisis and what they need to do now to capitalize on a strengthening economy. Lenders to the retail sector also learned something: that they have to be able to pivot quickly so they can provide financing in every phase of the economic cycle. Change can come unexpectedly, and it has been quite a ride.

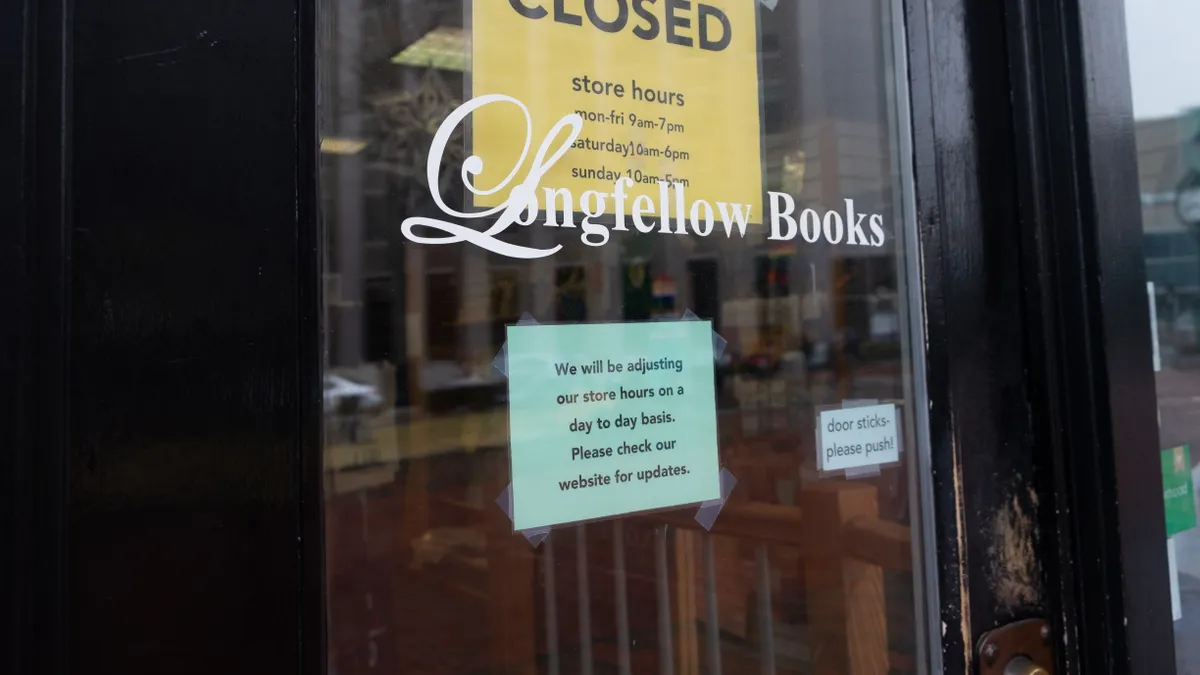

No matter how long you have been following the retail sector, it is a safe bet that you have never seen anything like 2020. When COVID-19 hit, customers stopped coming into stores, which meant brick-and-mortar retailers who depended mainly on foot traffic saw their business dry up. The competitive threat from the biggest players, who combined strong online operations with curbside pickup, only added to the pressure. Many retailers struggled, and some were forced to go through Chapter 11 bankruptcy. In 2020 alone, there were 30 major retail bankruptcies, according to Retail Dive, compared to an average of 17 between 2017 and 2019.

In many cases, lenders had to provide debtor-in-possession financing and work closely with their borrowers to provide the right funding solution for necessary operation and distribution model changes. They also had to make judgments about which companies had the ability to bounce back, a skill the best lenders have honed through experience. Many of the retailers that survived the trial by fire have emerged stronger as a result and can benefit by implementing the best practices of the winners, who had a few critical things in common:

- They communicated well. Retailers had to be transparent with everyone — vendors, landlords, lenders — to make it through the hard times. The merchants that did this best hung on to their customers and employees.

- They occupied niches they could defend. Retailers needed an edge — the right price, quality brands and merchandise that met consumer lifestyle trends, the ability to adapt their product lines and a good location — to remain competitive.

- They had strong e-commerce operations. E-commerce grew from 13% to 20% of sales from 2019 to 2020, according to Bloomberg, and retailers who had the foresight to invest in tools to facilitate ease-of-purchase and reliable delivery reaped the rewards.

- They had financing partners they could depend on. Those partners helped retailers weather the storm during the pandemic and stand ready to provide different kinds of financing solutions now that the sun is shining again.

Retail sales growth could reach record levels this year, according to the National Retail Federation estimates, which is not surprising given all the tailwinds driving it forward. Consumers saved money during the pandemic, and now that they have been vaccinated, they have returned to the stores to spend it. Several rounds of government stimulus are also helping, as are the improving job market and rising wages. It is hard to imagine a better set of circumstances.

Retailers, even those with challenged finances, are poised to take advantage of the turnaround. They are rebuilding their balance sheets and investing for growth, which includes putting money into expanded e-commerce capabilities. If it was not clear before, it is clear now that robust e-commerce operations are essential to staying relevant. Lenders are helping to make these improvements possible. They are providing funds for inventory, working capital and expansion.

Even as life returns to normal, it will not be the same as prior to the pandemic. Some subsectors like off-price are doing fabulously and were the first to see traffic return as the pandemic threat lifted — bargain hunters are a hardy lot. Others in retail, like mall stores, have seen a more muted recovery. No one can say exactly what mix of brick and mortar versus online sales will emerge, so retailers will need to be flexible.

If the past year has taught us anything, it is that conditions can change faster than we realize and that businesses need to be ready to pivot, or work together with a trusted capital provider to stay strong in any economic climate. Smart retailers will understand that and, as a result, will be better prepared for whatever comes next.