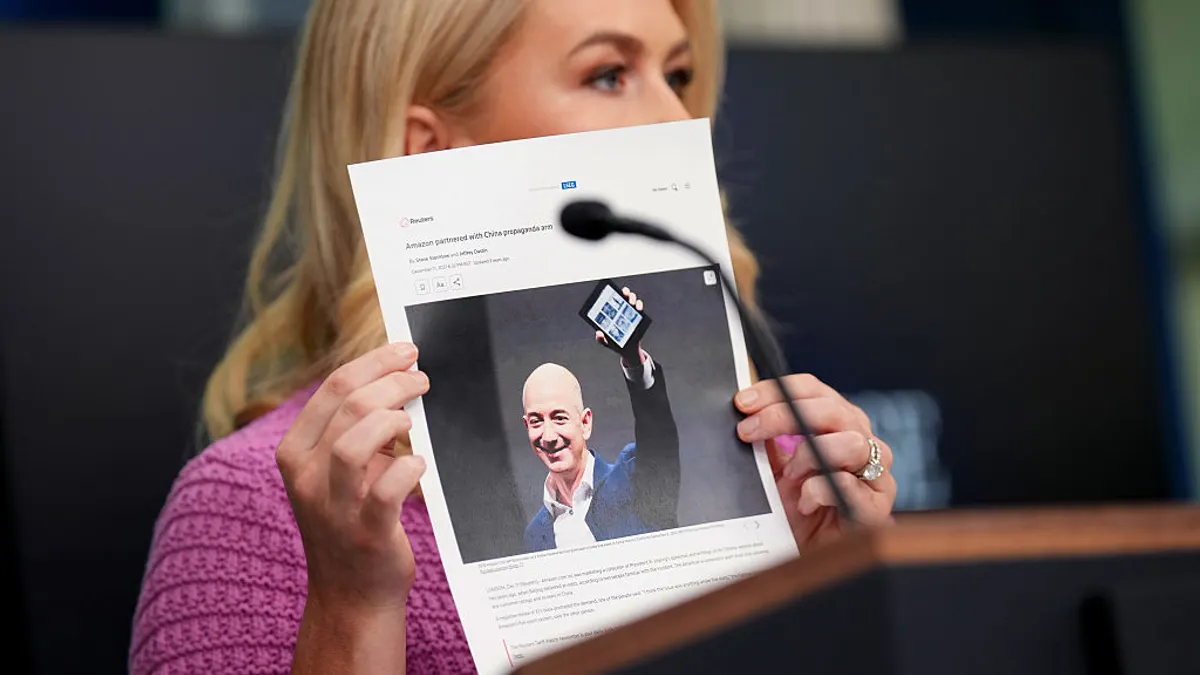

Customer communications around tariffs and prices were thrown into a political spotlight on Tuesday when White House press secretary Karoline Leavitt pilloried a reported plan by Amazon to flag some price hikes as caused by tariffs.

Leavitt, who said she had spoken to the president on the matter, said the move would be “a hostile and political act by Amazon.” The e-commerce giant almost immediately pushed back on the news, saying it had considered such a tactic for its super-cheap Amazon Haul site but that “this was never approved and is not going to happen.”

The Trump administration’s heated rhetoric may be understandable, given that frustration over inflation is widely seen as a major factor in the outcome of the presidential election. And because already worn-out U.S. consumers increasingly expect tariffs to worsen inflation and hurt the economy. But retailers are worried, too.

“Bottom line here is that customers are going to be impacted by tariffs across the board,” Anne Mezzenga, co-CEO of Omni Talk, said by email. “Product selection will be limited, and prices will be higher.”

The question is: What is an effective message?

Several companies anticipating the need to pass on higher import duties to consumers are mulling options like delineating tariff-related costs on shelves or receipts, Ali Furman, consumer markets industry leader at PwC, said earlier this week. This is similar to what was contemplated at Amazon, according to the reporter posing the question during Tuesday’s White House briefing. Nearly half (48%) of U.S. adults are “very interested” in seeing tariff-related price differentials listed on retailers’ websites, according to data from consumer analytics and advertising platform CivicScience.

While some consultants advocate for this kind of transparency, it would be a radical move, according to Kirthi Kalyanam, professor at Santa Clara University’s Leavey School of Business.

“There is historically zero precedent for communicating tariff-related information on pricing at the item level,” he said by phone. “If you have a very large number of products and coming from diverse places, then it becomes complicated. It becomes particularly messy.”

Pointing out higher prices is a sure way to send a customer away to look for a better deal, according to Kalyanam, Mezzenga and others. Gary Stibel, founder and CEO of the New England Consulting Group, who has “worked with Procter & Gamble and Walmart and with guys who compete with Procter & Gamble and Walmart,” said the firm has long counseled those companies to focus on value rather than price.

“If you have to take a price increase, take it. Don't rub it in the consumer's face,” he said by phone. “And by the way, at the same time you're [raising prices], announce something positive. ‘We have a free trial, we have a new flavor.’ Don’t run around and say, ‘Hey, by the way, we're taking price increases and the devil made me do it.’”

While Adidas CEO Bjørn Gulden was speaking to investors Tuesday when he said that “of course there will be price increases” in the U.S. if import duties remain, that news made headlines that could reach consumers, according to Stibel.

“This is why we created this commandment decades ago,” he said. “Adidas, we're not surprised you're [having to raise prices]. Why don’t you shout it a little louder so nobody will buy your damn stuff!”

Calling out tariff effects on the Amazon Haul site would have been akin to the twin notices from Chinese sites Shein and Temu about coming price increases “due to recent changes in global trade rules and tariffs.” Under the Trump administration’s trade policy, the three sites will soon stop benefiting from a decades-old exemption, known as the de minimis loophole, that has allowed products valued under $800 to enter the U.S. duty-free.

“That group of products is in deep s---,” Rick Watson, founder and CEO of RMW Commerce Consulting, said by phone. “You have to tell your customers something when you triple or double your prices overnight.”

But tariff-related messages ideally include good news for customers, he and others say. On April 3, just a day after President Donald Trump announced 10% baseline tariffs and other duties, U.K. men’s sock company London Sock Co. sent customers an email saying it would “continue to cover all duties, just as we always have,” adding, though, that “In the future we may need to make adjustments, but rest assured, we’ll always be upfront and fair with you.”

The socks may cost the same regardless of tariffs, but the value rises, Stibel said. “The value changes immensely, because now you know this merchant is looking out for you,” he said.

Others urge customers to place an order before tariffs kick in. On its website, made-in-America tie brand Beau Ties of Vermont, for example, warns that tariffs on its raw materials may impact its operations. “If you’ve been thinking about placing an order soon, we’d gently suggest that now is a good time,” the brand states. “Because we simply don’t know what the coming months will bring in terms of pricing.” Similarly, in April, Room & Board sent an email to customers from CEO Bruce Champeau saying, “If you’re considering a purchase, we want to provide some peace of mind: Our prices will stay the same through July.”

If prices do go up in July, Room & Board is unlikely to flag the tariff effect per item, Watson said. “They're probably just going to raise prices up,” he said. “And if they don’t, they can be like ‘We said prices might go up in July. We’re having a sale actually, instead.’”

Transparency can be a good thing, but retailers should be communicating strategically, according to Stibel.

“This is all about strategy, not pricing tactics, and value, not a number,” he said. “Price is a number. Value is an equation — what I get for what I pay.”