BIA/Kelsey analyst: Mine geofence data to align mobile with user objectives

For example, JCPenney leveraged geofence data to uncover that customers were engaging with the brand as they emerged from subway stations and was able to adjust its strategy to better address its customers objectives, according to the analyst. The “5 Trends Driving Location-Targeted Mobile Advertising” session explored the reasons for the ways in which brands and retailers can better leverage location-based mobile tactics.

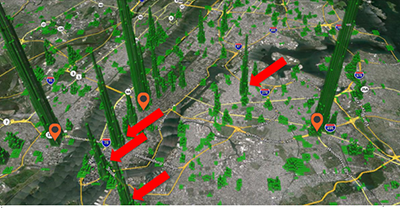

“The traditional geo fences draw a dumb circle around [a store],” said Michael Boland, senior analyst and vice president of content at BIA/Kelsey, San Francisco.

“Within that circle you might have areas where your target audience or affinity groups may not be,” he said.

Mobile Commerce Daily organized the Mobile Research Summit: Data & Insights 2014.

Locations within location

Mr. Boland said that marketers should use location-based tactics to track behavior and build more accurate consumer profiles.

The evolution of geofences is an example of how tracking consumer behavior goes on to enhance consumer engagement.

For instance, JC Penny deployed generic geofences around their stores in New York. The retailer then tracked where in these fences consumers were engaging with the brand. Predictably, the majority of brand engagement occurred within stores.

However, there were also spikes of activity in what at first seemed to be random spots throughout the city. Upon closer look, the retailer realized that these extra spikes occurred at subway stations, meaning that as consumers emerged from a station, they engaged with the brand.

The retailer was then able to better align the services of its geofences with the objectives of consumers.

Brands and retailers can drill even deeper into this data. Within the spikes of activity there are variations of behavior among different demographics or affinity groups.

Mr. Boland also stressed that push notifications need to be much more relevant otherwise consumers will suffer from severe brand fatigue.

“We’re going to see the need for predictive push in a way that alleviates message fatigue, privacy, battery drainage,” Mr. Boland said.

On-the-go

While mobile constitutes 20 percent of media consumption, the channel garners only 4 percent of total advertising spending. On the other end of the spectrum, print commands 19 percent of total ad spending and constitutes 5 percent of media consumption.

“[Mobile] intent tends to be more commercially driven when you’re out and about,” Mr. Boland said. “The opportunity to get in front of them and influence that decision is a key stage,” he said.

“Meet that intent and provide calls to action and content, and the ad creative that captures that intent.”

The prevailing forecast of mobile is that it will do a better job at influencing sales in-store than on devices. Consumers like to research products and brands with mobile devices and then leverage that information when shopping in stores, whether that means all-day excursions or a quick stop at a retailer after work.

Seventeen percent of mobile searches lead to store visits, 25 percent lead to visiting a retailer’s Web site and 36 percent lead to continued research.

When consumers do search for products or brands, they tend to have post-search actions in mind. In fact, 55 percent of purchase-related conversions occur within one hour of a mobile search.

Top secondary actions following a search include calls, accessing directions and maps and finding more information.

To be effective at influencing sales, brands should deploy location-based tactics. Consumers want to know where the closest store is, available inventory, current sales and other information.

Mike Boland of BIA/Kelsey at the Mobile Research Summit

The click-through rates of location-based ads are twice as high the click-through rates of non location-based ads. However, click-through rates may be a less accurate indicator of mobile influence than other outcomes such as in-store visits.

“When best practices are not upheld there’s a dark side to this where the ad networks are opportunistically moving into mobile in some disingenuous ways,” Mr. Boland said.

“You might be paying a premium on an allocation targeted ad that’s really off by miles,” he said.

Future of mobile

Mr. Boland argued that Apple’s iTunes may dominate mobile payments in the future, since the music service already has hundreds of millions of accounts.

Hypothetically, a consumer can go into a store, scan a product they want to buy and then have iTunes execute the purchase seamlessly. This holds the potential of eliminating the checkout line entirely and replacing it with a roving purchase process that mimics actual in-store behavior.

“The transactions happen in this roving manner rather than cramming [consumers] into the checkout line,” Mr. Boland said.

Final Take

Joe McCarthy, editorial assistant on Luxury Daily, New York