Dive Brief:

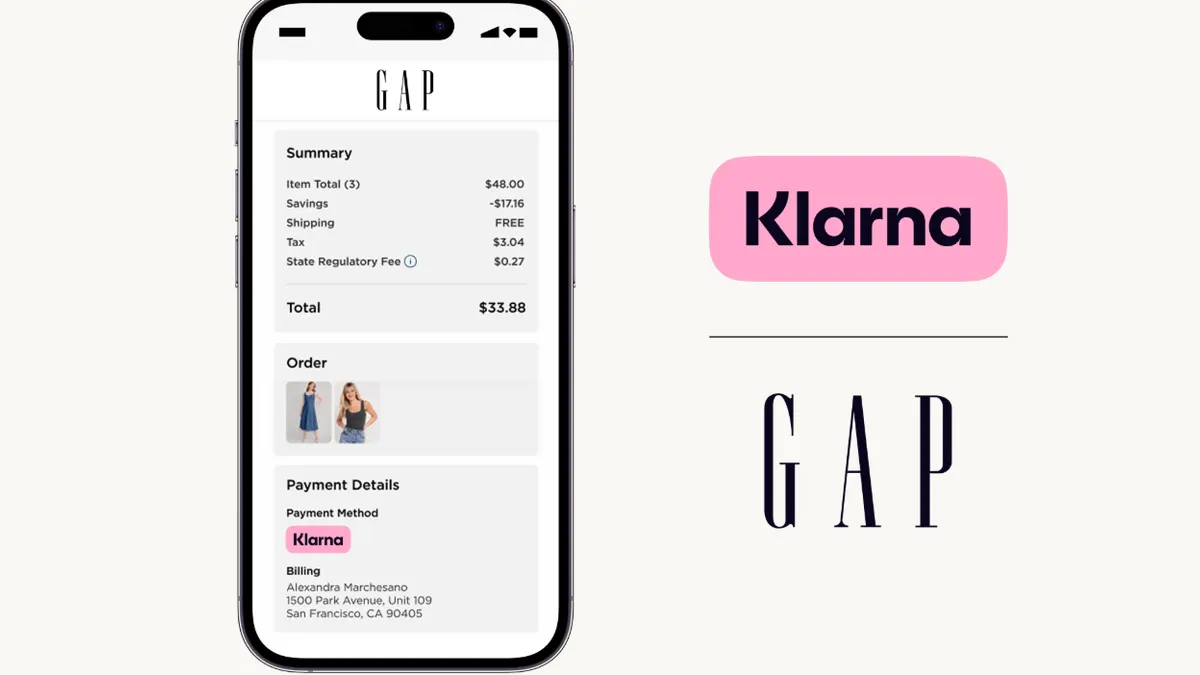

- Gap Inc. has partnered with Klarna to offer the payment provider’s services across its portfolio of brands including Old Navy, Gap, Banana Republic and Athleta.

- With Klarna, U.S. customers can pay for their Gap Inc. purchases in full or in four interest-free installments online or within the mobile app, according to a press release.

- The Gap Inc. partnership adds to Klarna’s growing customer base, which has surpassed 26 million U.S. shoppers and 724,000 sellers worldwide.

Dive Insight:

Gap Inc. wants to give shoppers different ways to pay. Other than the company teaming up with Klarna, the apparel retailer also allows customers to purchase items through Apple Pay and Afterpay, among other options.

"We are excited to offer our customers more choice, convenience and control by offering a variety of payment options across our portfolio of brands," Kevin Meiners, head of loyalty and payments at Gap Inc., said in a statement.

Gap Inc.’s partnership with Klarna comes as the company seeks to attract customers amid a turnaround. The company’s namesake brand recently unveiled its global fall 2025 campaign, which highlights its low-rise denim collection and stars girl group Katseye. Drawing inspiration from the early 2000s, Gap’s 90-second ad features singer Kelis’ hit song “Milkshake” and has largely been met with positive reviews.

Shortly after that campaign launch, Gap Inc. reported flat Q2 net sales and a 1% increase in comps compared to last year. Inventory increased 9% year over year, which the company attributed to tariffs and its effort to import products before duties increased.

Meanwhile, Klarna debuted on the New York Stock Exchange last week. The buy now, pay later platform aims to become “ubiquitous” at store checkouts as part of its growth strategy, Chief Commercial Officer David Sykes said.

In addition to announcing its partnership with Gap Inc., Klarna will begin to offer its short-term loans at Walmart later this month.

As Klarna adds more retail partners to its growing roster, research suggests that consumers, particularly younger shoppers, are turning to buy now, pay later providers as an alternative to credit cards.